StakeHolder Management

Getting votes to pass an amendment or consent is time consuming, inefficient, and often falls short. DealVector saves time & improves results—increasing your odds of successful passage.

Improve Delivery

Our proprietary asset registry directly notifies registered holders, avoiding delays & delivery failures. DTCC & custodial contact tools ensure we reach non-registered investors.

Increase Response

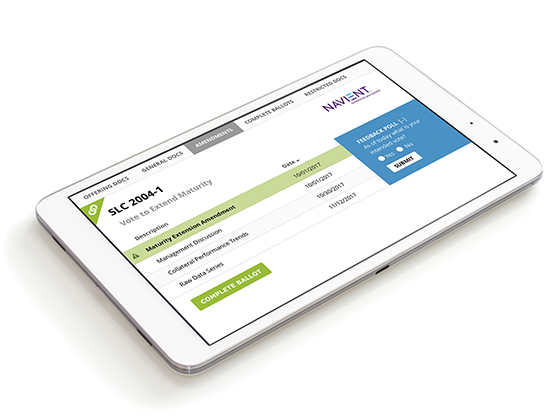

Turn any document into an e-Ballot, making it easier for investors to respond, and for you to track results in real time.

Mind the Gaps

Spot missing votes by custodian and by beneficial owners using our exception reporting tools. Target specific non-responders for follow up to ensure all votes are counted.

Outsource the Headaches

Ditch the repeated phone calls, emails, and spreadsheets. Turn it over to DealVector, and we’ll do the rest. Or, license our software and run your own process more efficiently.

How it Works

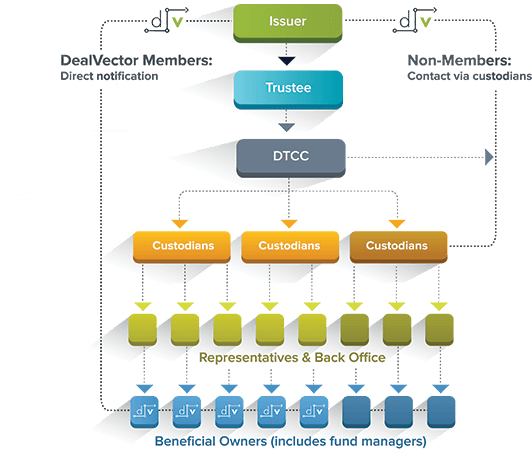

DealVector supplements the DTCC notification system by delivering notices directly to investors and custodians.

Why This is Important

- DTCC notices pass through many systems and participants, with each transition an opportunity for delay or misdirection.

- Decision-makers often receive critical materials at the last minute or after the deadline.

- One-way notification does not allow for dialogue between investor and issuer.

The Solution

- Instantly reach the inboxes of front office decision makers of DealVector’s 1000+ firms.

- Follow up with 900 DTCC custodial participants to reach non-members.

- Proprietary e-balloting and tabulation software tracks results and pinpoints any missing votes.

The result is increased reach, increased communication, and increased success.

Our 100% amendment passage rate on 9 trusts is attributable to the DealVector network. Instant ballot delivery, electronic voting and real-time investor communications were essential to our success.

GREER MCCURLEY NELNET

What Makes DealVector Unique

DealVector is the only information agent to operate a global asset registry and communication network of non-public holders, giving us direct access to investors with > $2T in holdings.

The DealVector Network

The DealVector Network

Our solicitation business is built on the foundation of our award-winning fixed income communication network. Over 1,300 firms have over $2T in positions on DealVector.

Two-Way Dialogue

Two-Way Dialogue

The ability of investors to respond to issuers via our identity-protected messaging platform allows issuers to address obstacles to “yes” votes in advance of the deadline.

Investor Outreach

Investor Outreach

We email and call every investor registered on our platform who holds your bond to ensure receipt and understanding of materials. Plus we reach out to public holders who have not yet joined.

e-Ballots

e-Ballots

Turn your legal document into an online form, making it easier for investors to respond, eliminating manual re-entry of data, and capturing data days ahead of the final deadline.

Tabulation Tools

Tabulation Tools

Manage vote counts online, not in Excel. Track pending votes from the moment they are completed until signed ballots arrive. Target custodians with low response rates. Save on expensive 3rd party

tabulation agents.

Custodial Network

Custodial Network

Our contact database and automated email engine allows us to reach out in a very targeted fashion to custodians with un-voted bonds. We combine this with old-fashioned relationship building.

InvestorLink

As paper trades, managers lose track. Then comes a vote. Or a new deal to place. InvestorLink keeps you in touch with a changing investor base.

Improve Investor Satisfaction

Deliver monthly reports & documents directly to their inbox; satisfy investor demands for transparency & communication.

Execute Consents

Ensure critical amendments pass, with direct document delivery, online voting & tabulation tools, and targeted identification of non-responders.

Boost Liquidity

Investors who can talk are investors who can trade. Give your investors more options.

Accelerate New Placements

Easily target existing holders when your next deal prints.

- LOADED DEAL VALUE $2T+

- LEADING FIRMS 1,300+

Our 100% amendment passage rate on 9 trusts is attributable to the DealVector network. Instant ballot delivery, electronic voting and real-time investor communications were essential to our success.Greer McCurley Nelnet